DOES ROBUSTA COFFEE COMMONITY NEED A FUTURES CONTRACT?

DOI:

https://doi.org/10.19184/jauj.v22i2.52494Keywords:

Coffee, Futures Contract, Hedging, SimulationAbstract

ABSTRACT

The coffee commodity is faced with a major problem, namely significant world price fluctuations which create financial risks in international trade in coffee commodities. Coffee exporters must manage risks arising from fluctuations in the price of robusta coffee in the commodity market. On the commodity exchange, futures contracts are available on coffee commodities which can be used to hedge risks. The aim of this research is to analyze whether robusta coffee exporters should implement hedging strategies or not. The analysis method used is a Monte Carlo simulation approach. The simulation was carried out to estimate commodity prices at the maturity date of the futures contract based on 960 historical data on daily commodity prices. Based on 500 experiments (simulations) on spot prices, the simulation results show that hedging using futures contracts tends to be better not done. Coffee commodity transactions on the physical market are considered to generate better income for exporters.

Keywords: Coffee; Futures Contract;Hedging; Simulation

ABSTRAK

Komoditas kopi dihadapkan permasalahan utama, yaitu fluktuasi harga dunia yang signifikan yang menimbulkan risiko finansial dalam perdagangan internasional komoditas kopi. Eksportir kopi harus mengelola risiko yang timbul karena fluktuasi harga kopi robusta di pasar komoditas. Pada bursa komoditas, tersedia kontrak futures pada komoditas kopi yang dapat digunakan untuk lindung nilai (hedging) atas risiko. Tujuan dari penelitian ini adalah untuk menganalisis apakah eksportir kopi robusta sebaiknya menerapkan strategi hedging atau tidak. Metode analisis data yang digunakan yaitu menggunakan pendekatan simulasi Monte Carlo. Simulasi dilakukan untuk mengestimasi harga komoditas pada masa jatuh tempo kontrak futures berdasarkan 960 data historis harga komoditas harian. Berdasarkan 500 kali percobaan (simulasi) pada harga spot, hasil simulasi menunjukkan bahwa hedging menggunakan kontrak futures cenderung lebih baik tidak dilakukan. Transaksi komoditas kopi pada pasar fisik dinilai menghasilkan pendapatan yang lebih baik untuk eksportir.

Kata Kunci: Hedging; Kontrak Futures; Kopi; Simulasi

Downloads

References

Donald Lien, & Y. K. Tse. (2002). Some Recent Developments in Futures Hedging. Journal Of Economic Survey, 16(3), 357–396. https://doi.org/10.1111/1467-6419.00172

Falótico, A. J. A., & Scudiero, E. (2023). Futures contracts as a means of hedging market risks. Aibi, Revista de Investigacion Administracion e Ingenierias, 11(3). https://doi.org/10.15649/2346030X.3185

Ismiyanti, F., & Sasmita, H. I. (2011). Efektivitas Hedging Kontrak Futures Komoditi Emas Dengan OLEIN. Jurnal Manajemen Teori Dan Terapan| Journal of Theory and Applied Management, 4(2), 54–67. https://doi.org/10.20473/jmtt.v4i2.2420

Li, B., Zhang, D., & Zhou, Y. (2017). Do trend following strategies work in Chinese futures markets? Journal of Futures Markets, 37(12), 1226–1254. https://doi.org/10.1002/fut.21856

Macias, A. E. A., Corilloclla, D. L. M., Porras, M. Y. J., Venero, R. M., & Quispe, J. A. D. (2022). Monte Carlo simulation in an elementary school building. Journal of Project Management (Canada), 7(3). https://doi.org/10.5267/j.jpm.2022.3.001

Madura, J. (2000). International Financial Management. Erlangga.

Mallongi, A., Rauf, A. U., Daud, A., Hatta, M., Al-Madhoun, W., Amiruddin, R., Stang, S., Wahyu, A., & Astuti, R. D. P. (2022a). Health risk assessment of potentially toxic elements in Maros karst groundwater: a Monte Carlo simulation approach. Geomatics, Natural Hazards and Risk, 13(1). https://doi.org/10.1080/19475705.2022.2027528

Michels, M., Möllmann, J., & Musshoff, O. (2019). Understanding the intention to use commodity futures contracts. Agricultural Finance Review, 79(5). https://doi.org/10.1108/AFR-02-2019-0025

Nordin, N., Daud, N., Ahmad, A. A., Bakar, N. A., & Ali, E. M. T. E. (2015). Gharar in forward and futures contracts? Mediterranean Journal of Social Sciences, 6(2). https://doi.org/10.5901/mjss.2015.v6n2p435

Penone, C., Giampietri, E., & Trestini, S. (2021). Hedging effectiveness of commodity futures contracts to minimize price risk: Empirical evidence from the italian field crop sector. Risks, 9(12). https://doi.org/10.3390/risks9120213

Perera, D., Białkowski, J., & Bohl, M. T. (2020). Does the tea market require a futures contract? Evidence from the Sri Lankan tea market. Research in International Business and Finance, 54. https://doi.org/10.1016/j.ribaf.2020.101290

Putri, A. O., Paramu, H., Endhiarto, T., Nusbantoro, A. J., & Susanto, A. B. (2023). Estimasi Profit Loss harga Kontrak Berjangka Kakao Untuk Kepentingan Pengambilan Keputusan Hedging. Journal Of Business Studies, 2, 44–45.

Qazi, A., Shamayleh, A., El-Sayegh, S., & Formaneck, S. (2021). Prioritizing risks in sustainable construction projects using a risk matrix-based Monte Carlo Simulation approach. Sustainable Cities and Society, 65. https://doi.org/10.1016/j.scs.2020.102576

Tanjung, A. F., Adha, R., & Marliyah. (2024). Analisis Perkembangan Pasar Derivatif di Indonesia. Jurnal EMT KITA, 8(1). https://doi.org/10.35870/emt.v8i1.2047

Utomo, L. L. (2000). Instrumen Derivatif: Pengenalan Dalam Strategi Manajemen Risiko Perusahaan. Jurnal Akuntansi Dan Keuangan, 2(1), 53–68. http://puslit2.petra.ac.id/ejournal/index.php/aku/article/view/15667. https://doi.org/10.9744/jak.2.1.pp.%2053-68

Downloads

Published

Issue

Section

License

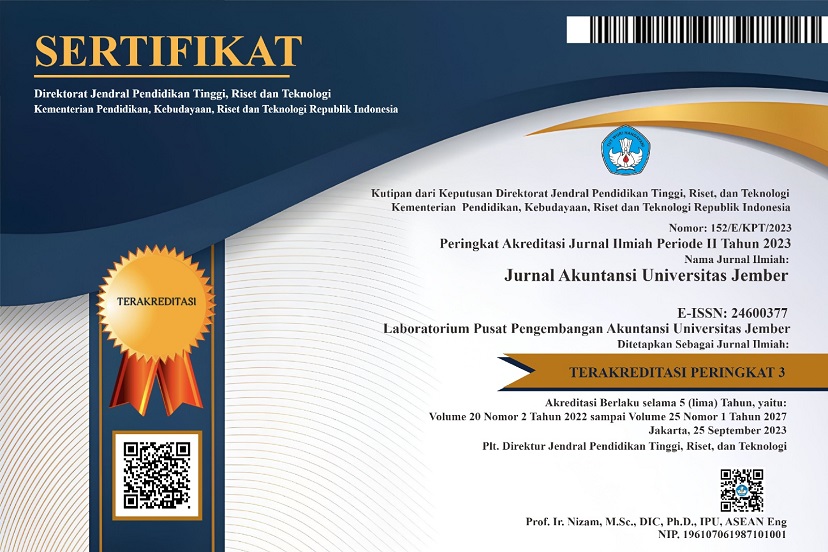

Copyright (c) 2024 JURNAL AKUNTANSI UNIVERSITAS JEMBER

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.