GENDER DIVERSITY OF EXECUTIVE, INTERNAL CONTROL, INSTITUTIONAL OWNERSHIP, FIRM SIZE AND TAX AVOIDANCE: AN INTERACTIVE EFFECTS BUSINESS STRATEGY

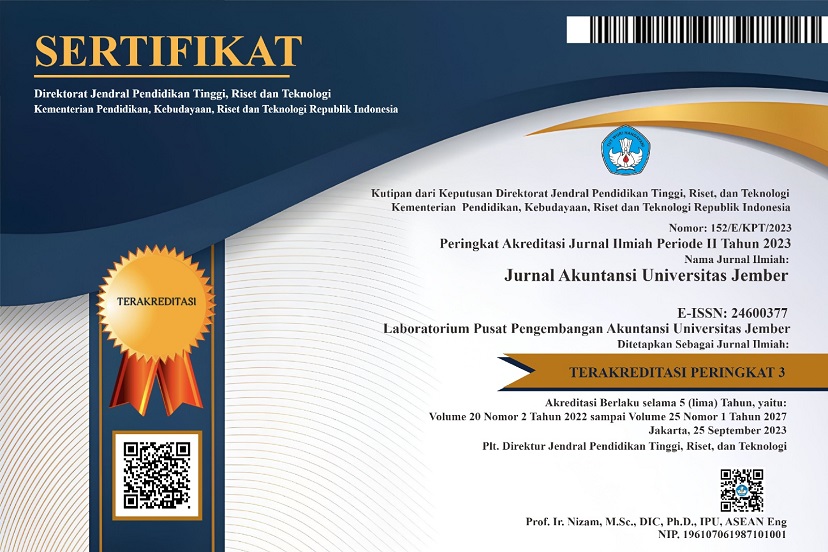

DOI:

https://doi.org/10.19184/jauj.v22i1.47764Keywords:

Firm Size, Gender Diversity, Institutional Ownership, Internal Control, Tax AvoidanceAbstract

ABSTRACT

Business strategy is crucial for companies to improve performance and map business opportunities and challenges to achieve maximum profits. This research aims to analyze the influence of gender diversity of executives, internal control, institutional ownership, and firm size on tax avoidance. An empirical study on manufacturing companies listed on the IDX for 2019 – 2023. This research contributes by considering the business strategy carried out by the company, which allows it to increase company profits. The number of data samples in this study was 41 manufacturing companies, and the total number of observations was 205. This research shows that gender diversity and institutional ownership do not affect tax avoidance. However, the gender diversity of executives and internal control influences tax avoidance. The results provide further insight into how companies use business strategies by considering executive gender diversity, internal control institutional ownership, and firm size to increase the effectiveness of tax avoidance.

Keywords: Firm Size; Gender Diversity; Institutional Ownership; Internal Control; Tax Avoidance

ABSTRAK

Strategi bisnis sangat penting bagi perusahaan untuk meningkatkan kinerja dan memetakan peluang dan tantangan bisnis untuk mencapai keuntungan maksimal. Penelitian ini bertujuan untuk menganalisis pengaruh gender diversity of executives, internal control, dan institutional ownership, firm size pada tax avoidance. Studi empiris pada perusahaan pertambangan yang terdaftar di BEI periode 2019-2023. Penelitian ini memberikan kontribusi dengan mempertimbangkan strategi bisnis yang dilakukan perusahaan yang memungkinkan dapat meningkatkan keuntungan perusahaan. Jumlah sampel data dalam penelitian ini sebanyak 41 perusahaan manufaktur dan jumlah observasi sebanyak 205. Hasil penelitian menunjukkan bahwa gender diversity, dan institutional ownership tidak berpengaruh terhadap tax avoidance. Namun, internal control dan firm size mempengaruhi tax avoidance. Hasilnya memberikan wawasan lebih lanjut tentang bagaimana perusahaan menggunakan strategi bisnis dengan mempertimbangkan gender eksekutif, pengendalian internal, kepemilikan institusional dan ukuran perusahaan untuk meningkatkan efektivitas penghindaran pajak.

Kata Kunci: Gender Diversity; Kepemilikan Institusional; Pengendalian Internal; Penghindaran Pajak; Ukuran Perusahaan

Downloads

References

Abdullah, S. N., Ismail, K. N. I. K., & Nachum, L. (2016). Does having women on boards create value? the impact of societal perceptions and corporate governance in emerging markets. Strategic Management Journal, 37(3), 466–476. https://doi.org/10.1002/smj.2352

Abigail, H., & Sudirgo, T. (2023). Pengaruh Profitabilitas, Leverage, Kepemilikan Institusional, dan Ukuran Perusahaan terhadap Penghindaran Pajak. Jurnal Multiparadigma Akuntansi, 5.

Alkurdi, A., & Mardini, G. H. (2020). The impact of ownership structure and the board of directors’ composition on tax avoidance strategies: empirical evidence from Jordan. Journal of Financial Reporting and Accounting, 18(4), 795–812. https://doi.org/10.1108/JFRA-01-2020-0001

Amani, T. (2022). The Effect of Net Profit, Operating Cash Flow and Company Size on Stock Return Companies Listed in LQ45 Index 2018-2020. Jurnal Akuntansi Universitas Jember, 20(2).

Aprilia, A. W., & Mulya, U. P. (2020). Pengaruh Karakteristik Direksi Terhadap Kinerja Perusahaan yang Terdaftar di Bursa Efek Indonesia Renita Febriany Luciana Haryono Nany Chandra Marsetio. Jurnal Akuntansi, 12(2), 233–255.

Astuti, D. F., Dewi, R. R., & Fajri, R. N. (2020). Pengaruh Corporate Governance dan Sales Growth terhadap Tax Avoidance di Bursa Efek Indonesia (BEI) 2014-2018. Ekonomis: Journal of Economics and Business, 4(1), 210. https://doi.org/10.33087/ekonomis.v4i1.101

Astuti, S., & Wati. (2020). Pengaruh Profitabilitas, Good Corporate Governance dan Intensitas Modal Terhadap Penghindaran Pajak pada Perusahaan Pertambangan Sektor Batu Bara di Bursa Efek Indonesia Periode 2016-2018. Jurnal Ilmiah Mahasiswa Manajemen, Bisnis Dan Akuntansi.

Anggie, M. A., & Mahpudin, E. (2024). Pengaruh Profitabilitas, Leverage dan Ukuran Perusahaan Terhadap Tax Avoidance Pada Perusahaan Manufaktur Sektor Barang Konsumsi Subsektor Makanan dan Minuman di Bursa Efek Indonesia Periode 2018-2022. Jurnal Ilmiah Wahana Pendidikan, 17(2), 656–664. https://jurnal.peneliti.net/index.php/JIWP/article/view/6812

Bimo, I. D., Prasetyo, C. Y., & Susilandari, C. A. (2019a). The Effect of Internal Control on Tax Avoidance: The Case of Indonesia. Journal of Economics and Development, 21(2), 131–143. https://doi.org/10.1108/jed-10-2019-0042

Bimo, I. D., Prasetyo, C. Y., & Susilandari, C. A. (2019b). The Effect of Internal Control on Tax Avoidance: The Case of Indonesia. Journal of Economics and Development, 21(2), 131–143. https://doi.org/10.1108/jed-10-2019-0042

Budiana, E., & Kusuma, H. (2022). The Relationship Between Gender Diversity and Tax Avoidance Practices. International Journal of Research in Business and Social Science (2147-4478), 11(8), 241–250. https://doi.org/10.20525/ijrbs.v11i8.2176

Deumes, R., & Knechel, W. R. (2018). Economic incentives for voluntary reporting on internal risk management and control systems. Auditing, 27(1), 35–66. https://doi.org/10.2308/aud.2008.27.1.35

Fajarani, P. M. (2021). Pengaruh Kepemilikan Manajerial, Kepemilikan Institusional dan Komite Audit terhadap Tax avoidance. Jurnal Bisnis Manajemen Dan Ekonomi, 19.

Fionasari, D., Putri, A. A., & Sanjaya, D. P. (2020). Analisis Faktor-Faktor yang Mempengaruhi Penghindaran Pajak pada Perusahaan Pertambangan di Bursa Efek Indonesia (BEI) Tahun 2016-2018. Jurnal IAKP, 1(1). http://tirto.id,

Firdaus, A. F., Nurlaela, S., & Masitoh, E. W. (2021). Institutional Ownership, Audit Quality, Gender Diversity and Political Connection to Tax Aggressiveness in Indonesia. JURNAL AKSI (Akuntansi Dan Sistem Informasi), 6(2), 91–100. https://journal.pnm.ac.id/index.php/aksi/article/view/91.

Fu’ad, K. (2015). Peran Penting Pengendalian Internal Dalam Sistem Informasi Akuntansi. Jurnal Akuntansi Universitas Jember, 27–36.

Ghaleb, B. A. A., Kamardin, H., & Tabash, M. I. (2020). Family ownership concentration and real earnings management: Empirical evidence from an emerging market. Cogent Economics and Finance, 8(1). https://doi.org/10.1080/23322039.2020.1751488

Ginting, S. (2016). Pengaruh Corporate Governance dan Kompensasi Rugi Fiskal terhadap Penghindaran Pajak dengan Ukuran Perusahaan Sebagai Variabel Moderating. In Jurnal Wira Ekonomi Mikroskil (Vol. 6).

Gleason, C., Pincus, M., & Rego, S. O. (2017). Material Weaknesses in Tax-Related Internal Controls and Last Chance Earnings Management Material Weaknesses in Tax-Related Internal. The Journal of the American Taxation Association, 39(1), 25–44.

Guat-Khim, H. (2024). CEO Power and Tax Avoidance in Malaysia: The Moderating Effect of Board Gender Diversity. Asian Academy of Management Journal of Accounting and Finance, 20(1), 97–119. https://doi.org/10.21315/aamjaf2024.20.1.3

Hoseini, M., Safari Gerayli, M., & Valiyan, H. (2019). Demographic characteristics of the board of directors’ structure and tax avoidance: Evidence from Tehran Stock Exchange. International Journal of Social Economics, 46(2), 199–212. https://doi.org/10.1108/IJSE-11-2017-0507

Huang, D. F., & Chang, M. L. (2016). Do auditor-provided tax services improve the relation between tax-related internal control and book-tax differences? Asia-Pacific Journal of Accounting and Economics, 23(2), 177–199. https://doi.org/10.1080/16081625.2014.1003570

Idzniah, U. N. L., & Bernawati, Y. (2020). Board of Directors, Audit Committee, Executive Compensation and Tax Avoidance of Banking Companies in Indonesia. Journal of Accounting and Strategic Finance, 3(2), 199–213. https://doi.org/10.33005/jasf.v3i2.111

Indriyanti, A. (2023). Profitability as a Moderator of Leverage and Firm Size on Tax Avoidance: Empirical Study at Indonesia Construction Companies. Eco-Fin, 5(3), 278–288. https://doi.org/10.32877/ef.v5i3.983

Kurnia, K. (2023). The Influence of Gender Diversity, Proportion of Independent Commissioners, Managerial Ability, and Company Size on Tax Avoidance. Jurnal Akuntansi Aktual, 10(2), 114. https://doi.org/10.17977/um004v10i22023p114

Liu, J.-L., & Tsai, C.-C. (2015). Board Member Characteristics and Ownership Structure Impacts on Real Earnings Management. Accounting and Finance Research, 4(4). https://doi.org/10.5430/afr.v4n4p84

Liuraman, Z., Kakanda, M. M., Abba, M., Kakanda, M. M., & Magaji, B. Y. (2020). Moderating Effect of Audit Quality on the Relationship Between Board Characteristics and Financial Performance of Listed Industrial Goods Companies in Nigeria. In Nigerian Journal of Accounting and Finance (Vol. 12, Issue 1).

Mala, N. N., & Ardiyanto, D. (2021). Pengaruh Diversitas Gender Dewan Direksi dan Ukuran Dewan Direksi terhadap Penghindaran Pajak (studi empiris pada perusahaan perbankan yang terdaftar di bei tahun 2014-2018). Diponegoro Journal of Accounting, 10.

Mangoting, Y., Yuliana, O. Y., Valencia, E., & Utomo, C. P. M. (2022). Ownership Structure, Tax Risk, and Tax Avoidance in Indonesia Manufacturing Companies 2016-2020. Jurnal Ilmiah Akuntansi Dan Bisnis, 17(2), 345. https://doi.org/10.24843/jiab.2022.v17.i02.p11

Marques, M. (2024). Tax Avoidance and Corporate Social Responsibility: A Meta-Analysis. Journal of the American Taxation Association, 46(1), 137–156. https://doi.org/10.2308/jata-2022-026

Marwa, T., Wahyudi, T., Maulana, Тауфік, М., & Тертіарто, В. (2018). The Effect of Transfer Pricing, Capital Intensity and Financial Distress on Tax Avoidance With Firm Size as Moderating Variables. Modern Economics, 11(1), 122–128. https://doi.org/10.31521/modecon.v11(2018)-20

Minnick, K., & Noga, T. (2010). Do Corporate Governance Characteristics Influence Tax Management? Journal of Corporate Finance, 16(5), 703–718. https://doi.org/10.1016/j.jcorpfin.2010.08.005

Nasir, N. E. M. (2023). Corporate Tax Avoidance: Evidence From Trading and Services Companies. https://doi.org/10.15405/epsbs.2023.11.02.31

Palupi, I. D., Kurniawati, L., & Wijayanto, K. (2021). The Effectiveness of Corporate The Effectiveness of Corporate Governance Components as Governance Components as a Control Mechanism in Detecting Tax a Control Mechanism in Detecting Tax Avoidance When the Company is Under Avoidance When the Company is Under Financial Pressure Financial Pressure. Jurnal Riset Akuntansi Dan Keuangan, 6(3), 242–254. http://journals.ums.ac.id/index.php/reaksi/index

Puspita, S., & Marsono, S. (2020). Pengaruh Profitabilitas, Leverage, Dan Ukuran Perusahaan Terhadap Penghindaran Pajak. Aktual: Journal of Accounting And Financial, 5(1), 45–52. www.cnbcindonesia.com.

Raharjanti, R. (2019). Gender Diversity, Kepemilikan Sahan, Kinerja Perusahaan: Studi Pada Perusahaan Perbankan di Indonesia. Jurnal Aktual Akuntansi,Bisnis Terapan, 2(2), 33–42.

Rais, Yunita, & Yusra. (2023). Pengaruh Profitabilitas, Leverage, Ukuran Perusahaan, Kepemilikan Institusional dan Capital Intensity terhadap Tax avoidance. Jurnal Ekonomika Indonesia, 12.

Reskino, R. (2023). Profit Management, Capital Intensity, Gender Diversity, on Tax Avoidance With Corporate Sustainability as an Intervening Variable. Jurnal Indonesia Sosial Sains, 4(10), 1075–1082. https://doi.org/10.59141/jiss.v4i10.903

Ricky. (2023). Pengaruh Profitabilitas, Leverage,Ukuran Perusahaan, dan Kepemilikan Institusional terhadap Tax Avoidance. Global Accounting : Jurnal Akuntansi , 2(2), 1–10.

Sadeva, B. S., Suharno, & Sunarti. (2014). Studi pada Perusahaan Pertambangan yang Terdaftar Dalam Bursa Efek Indonesia Tahun.

Sarimin, D. M., & Oktari, Y. (2023). Analisis Pengaruh Profitabilitas, Leverage, Ukuran Perusahaan, Kepemilikan Institusional, Tax Avoidance. ECo-Fin, 5(1), 13–24. https://doi.org/10.32877/ef.v4i1.454

Septiani, D. H. (2023). Directors Diversity, Business Strategy, Sales Growth on Tax Avoidance. Jurnal Aset (Akuntansi Riset), 14(1), 145–158. https://doi.org/10.17509/jaset.v14i1.52900

Setiawati, R. A., & Ammar, M. (2022). Muhammad Ammar Analisis Determinan Tax Avoidance Perusahaan Sektor Pertambangan di Indonesia. Jurnal MANOVA Volume V Nomor 2, 2685–4716.

Simamora, S. J. P., & Sari, D. P. (2021). Influence of Independent Director, Female Director, and Thin Capitalization on Tax Avoidance. Journal of Auditing, Finance, and Forensic Accounting, 9(2), 12–23. https://doi.org/10.21107/jaffa.v9i2.12034

Stawati, V. (2020). Pengaruh Profitabilitas, Leverage dan Ukuran Perusahaan terhadap Penghindaran Pajak. Jurnal Akuntansi Dan Bisnis: Jurnal Program Studi Akuntansi.

Suryani, S. (2021). Pengaruh Profitabilitas, Ukuran Perusahaan, Pertumbuhan Penjualan dan Kualitas Audit terhadap Tax Avoidance. Jurnal Akuntansi Dan Keuangan, 10(1), 19. https://doi.org/10.36080/jak.v10i1.1428

Tanujaya, K., & Anggreany, E. (2021). Hubungan Dewan Direksi, Keberagaman Gender Dan Kinerja Berkelanjutan Terhadap Penghindaran Pajak. Fair Value Jurnal Ilmiah Akuntansi Dan Keuangan, 4(5), 1648–1666. https://doi.org/10.32670/fairvalue.v4i5.754

Winasis, S. E., Nur, E., & Yuyetta, A. (2017). Pengaruh Gender Diversity Eksekutif terhadap Nilai Perusahaan, Tax Avoidance sebagai Variabel Intervening: Studi Kasus pada Perusahaan Pertambangan yang terdaftar di BEI tahun 2012-2015. Diponegoro Journal of Accounting, 6(1), 1–14. http://ejournal-s1.undip.ac.id/index.php/accounting