PENGUNGKAPAN INFORMASI DANA CORPORATE SOCIAL RESPONSIBILITY DAN REAKSI INVESTOR: STUDI EMPIRIS PADA INDEX LQ45

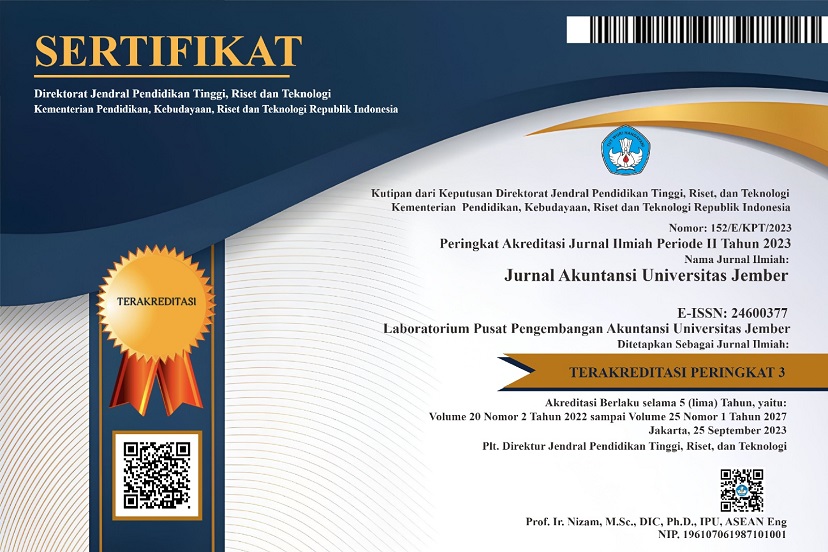

DOI:

https://doi.org/10.19184/jauj.v21i1.39412Keywords:

CSR Funds, Market Reaction, Sustainability ReportsAbstract

The sustainability report publishes financial, social, and environmental information. The report contains mostly qualitative information and some quantitative data. This research aims to identify the elements in a sustainability report that are needed by investors in making investment decisions. The research tests the information in the form of Corporate Social Responsibility fund amounts disclosed by companies in their sustainability reports. The benchmark for investor reaction is measured using stock prices, which are then calculated for their cumulative abnormal returns. The research method uses t-tests to determine the level of significance, which is further explained using legitimacy theory and signal theory. The sample used consists of companies listed on the LQ45 index. This study shows that information in the form of CSR fund amounts influences investor decision-making. Based on these results, it can be concluded that investors or stakeholders require information, specifically in the form of CSR fund amounts as one of the elements in the sustainability report.

Keywords: CSR Funds, Market Reaction, Sustainability Reports

ABSTRAK

Laporan keberlanjutan mempublikasikan informasi keuangan, sosial dan lingkungan. Di dalam laporan tersebut terdapat informasi yang sebagian besar kualitatif dan beberapa kuantitatif. Penelitian ini bertujuan untuk mengetahui apa saja elemen pada laporan keberlanjutan yang dibutuhkan oleh investor dalam pengambilan keputusan investasi. Penelitian ini melakukan uji pada informasi dalam bentuk nominal dana CSR yang diungkapkan oleh perusahaan pada laporan keberlanjutannya. Tolak ukur reaksi investor menggunakan harga saham yang kemudian dihitung cumulative abnormal return-nya. Metode penelitian menggunakan uji-t untuk mengetahui tingkat signifikansinya yang kemudian dijelaskan menggunakan teori legitimasi dan teori sinyal. Sampel yang digunakan adalah perusahaan yang terdaftar pada indeks LQ45. Penelitian ini menunjukkan bahwa informasi dalam bentuk nominal CSR berpengaruh pada pengambilan keputusan investor. Berdasarkan hasil ini, dapat disimpulkan bahwa investor atau stakeholder membutuhkan informasi dalam bentuk nominal khususnya dana CSR pada elemen laporan keberlanjutan.

Kata kunci: Dana CSR, Reaksi Pasar, Laporan Keberlanjutan

Downloads

References

Arum, R.N., dan Amalia, D. (2022). CSR Disclosure Quality: The Impact of Stand-alone Reports, Assurances, Reporting Guidelines, and Stakeholders, Jurnal Rekayasa Keuangan, Syariah dan Audit, Vol. 9, No. 2, pp. 91-99. https://doi.org/10.12928/jreksa.v9i2.6768.

Connelly, B. L., Certo, S. T., Ireland, R. D., & Reutzel, C. R. (2011). Signaling Theory: A Review and Assessment, Journal of Management, Vol. 37, No. 1, pp. 39-67. https://doi.org/10.1177/0149206310388419.

Damanik, L. Y. (2017). Pengaruh Kinerja Keuangan dan Karakteristik Perusahaan terhadap Kuantitas dan Kualitas Pengungkapan Sustainability Report di Indonesia Periode 2013-2015, Jurnal PROFITA, Vol. 10, No. 3, 228-246. http://dx.doi.org/10.22441/journal%20profita.v10i2.2900.

Deegan, C.M. (2019). Legitimacy theory: Despite its enduring popularity and contribution, time is right for a necessary makeover, Accounting Auditing & Accountability Journal, Vol 32 No. 8, pp. 2307-2329. https://doi.org/10.1108/AAAJ-08-2018-3638.

Gujarati, D. N., & Porter, D. C. (2009). Basic econometrics (5th ed.). McGraw-Hill. ISBN: 978-0-07-337577-9.

Trihatmoko, H., Ningsih, S., dan Mubaraq, M. R. (2020). Standalone Report, Assurance Report, GRI Reporting Framework dan Kualitas Pengungkapan Sustainability Report, Jurnal Manajemen dan Jurnal Akuntansi, Vol. 5, 142-156. http://dx.doi.org/10.32493/keberlanjutan.v5i2.y2020.p142-156.

Kamila, R.R., Anugerah, E.G., dan Maharani, B. (2022). What Drives the Disclosure of Corporate Philanthropy? An Indonesian Context, Journal of Islamic Finance and Accounting, Vol. 5, No. 1, pp 29-39. https://doi.org/10.22515/jifa.v5i1.5352.

Kennedy, P. (1992). A Guide to Econometrics. Oxford: Blackwell. ISBN: 978-1-405-18257-7.

Kutner, M. H., Nachtsheim, C. J., Neter, J., dan Li, W. (2005). Applied linear statistical models (5th ed.). McGraw Hill/Irwin. ISBN 0-07-238688-6.

Meiyana, A., dan Aisyah, M.N. (2019). Pengaruh Kinerja Lingkungan, Biaya Lingkungan, Dan Ukuran Perusahaan Terhadap Kinerja Keuangan Dengan Corporate Social Responsibility Sebagai Variabel Intervening, Jurnal NOMINAL, Vol. 8 No. 1, 1-18. https://doi.org/10.21831/nominal.v8i1.24495.

Menard, S. (2001). Applied Logistic Regression Analysis: Sage University Series on Quantitative Applications in the Social Sciences, 2nd Edition. Sage Publications, Inc. ISBN: 0761922083.

Michelon, G., Pilonato, S., dan Ricceri, F. (2015). CSR Reporting Practices and the Quality of Disclosure: An Empirical Analysis, Critical Perspectives on Accounting, Vol. 33, 59-78. https://doi.org/10.1016/j.cpa.2014.10.003.

Nursasi, E. (2020). Pengaruh Kinerja Keuangan Terhadap Nilai Perusahaan Dengan CSR Sebagai Variabel Moderasi. Jurnal Akuntansi dan Investasi, Vol. 5, No. 1, 29-44. http://dx.doi.org/10.53712/aktiva.v5i1.824.

O’brien, R. M. (2007). A Caution Regarding Rules of Thumb for Variance Inflation Factors, Quality & Quantity, Vol. 41(5), 673–690. https://doi.org/10.1007/s11135-006-9018-6.

Pérez, A. (2015), Corporate reputation and CSR reporting to stakeholders: Gaps in the literature and future lines of research, Corporate Communications: An International Journal, Vol. 20 No. 1, pp. 11-29. https://doi.org/10.1108/CCIJ-01-2014-0003.

Stock, J. H., dan Watson, M. W. (2020). Introduction to econometrics (4th ed.). Pearson. ISBN-13: 9780136879787.

Yarnest. (2019). Analisis Rasio Keuangan Pengukur Kinerja Perusahaan dan Pengaruhnya Terhadap Harga Saham dan Ekspektasi Return Saham sebagai Bahan Pengambilan Keputusan bagi Investor, Jurnal Belantika Pendidikan, Vol.2 (2), 87-101. https://doi.org/10.47213/bp.v2i2.35.

Yasar, B., Martin, T., dan Kiessling, T. (2020). An empirical test of signalling theory, Management Research Review, Vol. 43, No. 11, pp 1309-1335. https://doi.org/10.1108/MRR-08-2019-0338.