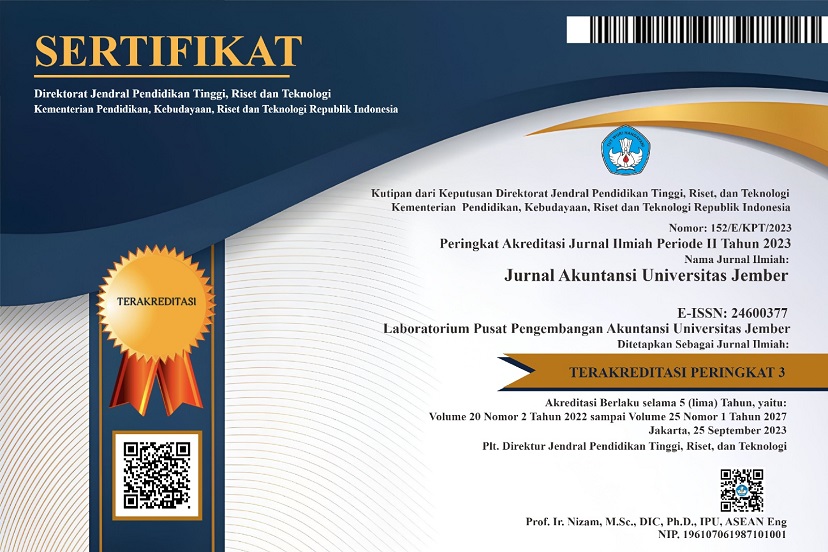

PENGARUH FRAUD HEXAGON TERHADAP FRAUDULENT FINANCIAL STATEMENT

(Studi Empiris pada Perusahaan Manufaktur yang Terdaftar di Bursa Efek Indonesia Periode 2017-2021)

DOI:

https://doi.org/10.19184/jauj.v21i2.38169Keywords:

Fraud, Fraud Hexagon, Fraudulent Financial StatementAbstract

ABSTRACT

Fraudulent financial statements are actions that are carried out in a planned manner that harm other parties by presenting incorrect financial information. This research aims to analyze the influence of the fraud hexagon theory, that measured with financial stability, external pressure, financial target, state owned enterprises, ineffective monitoring, and frequent number of CEO’s picture on fraudulent financial statement, empirical study on companies listed on the IDX for the period 2017 – 2021. This research contributes by considering more conditions that affect the possibility of fraud. The number of data samples in this study were 81 manufacturing companies and the total number of observations was 405. This study used Logistic Regression analysis which was processed using SPSS V25. The results of this study indicate that external pressure, state owned enterprises, and frequent number of CEO’s picture has a positive effect on fraudulent financial statement, while financial stability, financial target, and ineffective monitoring does not have effect on fraudulent financial statement. It is hoped that the company will further improve the control of the company, especially in dealing with fraud in financial statements based on the fraud hexagon theory.

Keywords: Fraud, Fraud Hexagon, Fraudulent Financial Statement

ABSTRAK

Fraudulent financial statement merupakan perbuatan yang dilakukan secara terencana yang merugikan pihak lain dengan cara menyajikan informasi keuangan yang salah. Penelitian ini bertujuan untuk menganalisis pengaruh teori fraud hexagon, dengan menggunakan pengukuran financial stability, external pressure, financial target, state owned enterprises, ineffective monitoring, dan frequent number of CEO’s picture terhadap fraudulent financial statement, studi empiris pada perusahaan yang terdaftar di BEI periode 2017 – 2021. Penelitian ini memberi kontribusi dengan mempertimbangkan lebih banyak kondisi yang mempengaruhi kemungkinan terjadinya kecurangan. Jumlah sampel data pada penelitian ini adalah 81 perusahaan manufaktur dan jumlah total observasi 405. Penelitian ini menggunakan analisis Regresi Logistik yang diolah menggunakan SPSS V25. Hasil penelitian ini menunjukan bahwa kondisi external pressure, state owned enterprises, dan frequent number of CEO’s picture berpengaruh positif terhadap peluang terjadinya kecurangan laporan keuangan. Sedangkan financial stability, financial target, dan ineffective monitoring tidak berpengaruh terhadap fraudulent financial statement. Diharapkan perusahaan untuk lebih meningkatkan pengendalian/kontrol mereka terutama dalam mengatasi kecurangan dalam laporan keuangan berdasarkan teori fraud hexagon.

Kata Kunci: Fraud, Fraud Hexagon, Kecurangan Laporan Keuangan

Downloads

References

Agustina, R. D., & Pratomo, D. (2019). Pengaruh Fraud Pentagon Dalam Mendeteksi Kecurangan Pelaporan Keuangan. Jurnal Ilmiah Manajemen, Ekonomi, & Akuntansi (MEA), 3(1), 44–62. https://doi.org/10.31955/mea.vol3.iss1.pp44-62

AICPA. (2002). Statement on Auditing Standards: SAS No. 99. In AU Section 316, Consideration of fraud in a financial statement audit.

Alfina, D. F., & Amrizal, A. (2020). Pengaruh faktor tekanan, peluang, rasionalisasi, kompetensi, dan arogansi terhadap kecurangan laporan keuangan. Akuntabilitas: Jurnal Ilmu Akuntansi, 13(1), 63–76. https://doi.org/10.15408/akt.v13i1.14497

Apriliana, S., & Agustina, L. (2017). The analysis of fraudulent financial reporting determinant through fraud pentagon approach. Jurnal Dinamika Akuntansi, 9(2), 154–165. https://doi.org/10.15294/jda.v7i1.4036

Arens, A. A., Elder, R. J., & Beasley, M. S. (2008). Auditing dan jasa assurance pendekatan terintegrasi. Jilid I, Penerbit Erlangga, Jakarta.

Bawekes, H. F., Simanjuntak, A. M. A., & Daat, S. C. (2018). Pengujian teori fraud pentagon terhadap fraudulent financial reporting. Jurnal Akuntansi Dan Keuangan Daerah, 13(1), 114–134. https://doi.org/10.4236/chnstd.2022.113014

Clinard, M. B., & Cressey, D. R. (1954). Other People’s Money: A Study in the Social Psychology of Embezzlement. American Sociological Review. https://doi.org/10.2307/2087778

Dechow, P. M., Ge, W., Larson, C. R., & Sloan, R. G. (2011). Predicting Material Accounting Misstatements. Contemporary Accounting Research, 28(1), 17–82. https://doi.org/10.1111/j.1911-3846.2010.01041.x

Fraud, O. (2022). A Report to the nations. ACFE: Https://Acfepublic. S3. Us-West-2. Amazonaws. Com/2022+ Report+ To+ The+ Nations. Pdf, 8, 2023.

Gaio, C., & Pinto, I. (2018). The role of state ownership on earnings quality: evidence across public and private European firms. Journal of Applied Accounting Research, 19(2). https://doi.org/10.1108/JAAR-07-2016-0067

Handoko, B. L., & Aurelia, E. (2021). Fraud Hexagon Analysis for Detecting Potential Fraudulent Financial Reporting in Manufacture Sector. 60–67. https://doi.org/10.1145/3483816.3483829

Jannah, V. M., Andreas, A., & Rasuli, M. (2021). Pendekatan Vousinas Fraud Hexagon Model dalam Mendeteksi Kecurangan Pelaporan Keuangan. Studi Akuntansi Dan Keuangan Indonesia, 4(1), 1–16. https://doi.org/10.21632/saki.4.1.1-16

Jaya, I., & Poerwono, A. A. A. (2019). Pengujian Teori Fraud Pentagon Terhadap Kecurangan Laporan Keuangan Pada Perusahaan Pertambangan di Indonesia. Jurnal Ilmu Akuntansi, 12(2), 157–168. https://doi.org/10.23969/jrak.v14i1.5286

Jensen, M. C., & Meckling, W. H. (1976). Teori perusahaan: perilaku manajerial, biaya agensi dan struktur kepemilikan. Jurnal Ekonomi Keuangan, 3(4), 305–360. https://doi.org/10.1016/0304-405X(76)90026-X

Kayoi, S. A., & Fuad, F. (2019). Faktor-Faktor Yang Mempengaruhi Financial Statement Fraud Ditinjau Dari Fraud Triangle Pada Perusahaan Manufaktur Di Bursa Efek Indonesia Periode 2015-2017. Diponegoro Journal of Accounting, 8(4). http://dx.doi.org/10.29040/jap.v23i1.5691

Kusumosari, L., & Solikhah, B. (2021). Analisis Kecurangan Laporan Keuangan Melalui Fraud Hexagon Theory. Fair Value: Jurnal Ilmiah Akuntansi Dan Keuangan, 4(3), 753–767. https://doi.org/10.32670/fairvalue.v4i3.735

Larum, K., Zuhroh, D., & Subiyantoro, E. (2021). Fraudlent Financial Reporting: Menguji Potensi Kecurangan Pelaporan Keuangan dengan Menggunakan Teori Fraud Hexagon. AFRE Accounting and Financial Review, 4(1), 82–94. https://doi.org/10.26905/afr.v4i1.5818

Marks, J. (2012). The mind behind the fraudsters crime: Key behavioral and environmental elements. Crowe Howarth LLP (Presentation).

Meini, Z., Safuan, S., Dewo, S. A., & Diyanti, V. (2018). Business cycles and earnings persistence: evidence from the ASEAN-5 countries. International Journal of Economics and Management, 12(S1), 105–118. https://doi.org/10.1016/j.econmod.2023.106382

Meini, Z., & Siregar, S. V. (2014). The effect of accrual earnings management and real earnings management on earnings persistence and cost of equity. Journal of Economics, Business, & Accountancy Ventura, 17(2), 269–280. http://dx.doi.org/10.14414/jebav.v17i2.309

Mertha Jaya, I. M. L., & Poerwono, A. A. A. (2019). Pengujian Teori Fraudpentagon Terhadap Kecurangan Laporan Keuangan Pada Perusahaanpertambangandiindonesia. Akuntabilitas, 12(2), 157–168. https://doi.org/10.15408/akt.v12i2.12587

Purwati, A. S., Persada, Y. D., Budianto, R., Suyono, E., & Khotimah, S. (2022). Financial Reporting Manipulation on Mining Companies in Indonesia: Fraud Diamond Theory Approach. Jurnal Riset Akuntansi Kontemporer, 14(1), 115–121. https://doi.org/10.23969/jrak.v14i1.5286

Ratmono, D., Darsono, D., & Cahyonowati, N. (2020). Financial statement fraud detection with beneish M-score and dechow F-score model: an empirical analysis of fraud pentagon theory in Indonesia. International Journal of Financial Research, 11(6), 154. https://doi.org/10.5430/ijfr.v11n6p154

Rengganis, R. M. Y. D., Sari, M. M. R., Budiasih, I. G. A. ., Wirajaya, I. G. A., & Suprasto, H. B. (2019). The fraud diamond: element in detecting financial statement of fraud. International Research Journal of Management, IT and Social Sciences, 6(3), 1–10. https://doi.org/10.21744/irjmis.v6n3.621

Rusmana, O., & Tanjung, H. (2020). Identifikasi kecurangan laporan keuangan dengan fraud pentagon studi empiris BUMN terdaftar di Bursa Efek Indonesia. Jurnal Ekonomi, Bisnis, Dan Akuntansi, 21(4). https://doi.org/10.32424/jeba.v21i4.1545

Sagala, S. G., & Siagian, V. (2021). Pengaruh Fraud Hexagon Model Terhadap Fraudulent Laporan Keuangan pada Perusahaan Sub Sektor Makanan dan Minuman yang Terdaftar di BEI Tahun 2016-2019. Jurnal Akuntansi, 13(2), 245–259. https://doi.org/10.28932/jam.v13i2.3956

Sasongko, N., & Wijayantika, S. F. (2019). Faktor Resiko Fraud Terhadap Pelaksanaan Fraudulent Financial Reporting (Berdasarkan Pendekatan Crown’s Fraud Pentagon Theory). Riset Akuntansi Dan Keuangan Indonesia, 4(1), 67–76. https://doi.org/10.23917/reaksi.v4i1.7809

Setiawati, E., & Baningrum, R. M. (2018). Deteksi fraudulent financial reporting menggunakan analisis Fraud Pentagon: Studi kasus pada perusahaan manufaktur yang listed di BEI Tahun 2014-2016. Riset Akuntansi Dan Keuangan Indonesia, 3(2), 91–106. https://doi.org/10.23917/reaksi.v3i2.6645

Skousen, C. J., Smith, K. R., & Wright, C. J. (2009). Detecting and predicting financial statement fraud: The effectiveness of the fraud triangle and SAS No. 99. https://doi.org/10.1108/S1569-3732(2009)0000013005

Sulkiyah. (2016). Pengaruh Ineffective Monitoring Terhadap Financial Statement Fraud (Perusahaan Manufaktur Yang Terdaftar Di BEI). Journal Ilmiah Universitas Gunung Rinjani. https://doi.org/10.53952/jir.v3i1.237

Vousinas, G. L. (2019). Advancing theory of fraud: the SCORE model. Journal of Financial Crime, 26(1), 372–381. https://doi.org/10.1108/JFC-12-2017-0128

Wicaksana, E. A. (2019). Pendeteksian kecurangan laporan keuangan pada perusahaan pertambangan di bursa efek indonesia. Jurnal RAK (Riset Akuntansi Keuangan), 4(1), 44–59. http://dx.doi.org/10.31002/rak.v4i1.1381

Wolfe, D. T., & Hermanson, D. R. (2004). The fraud diamond: Considering the four elements of fraud. https://doi.org/10.1016/S1361-3723(04)00065-X