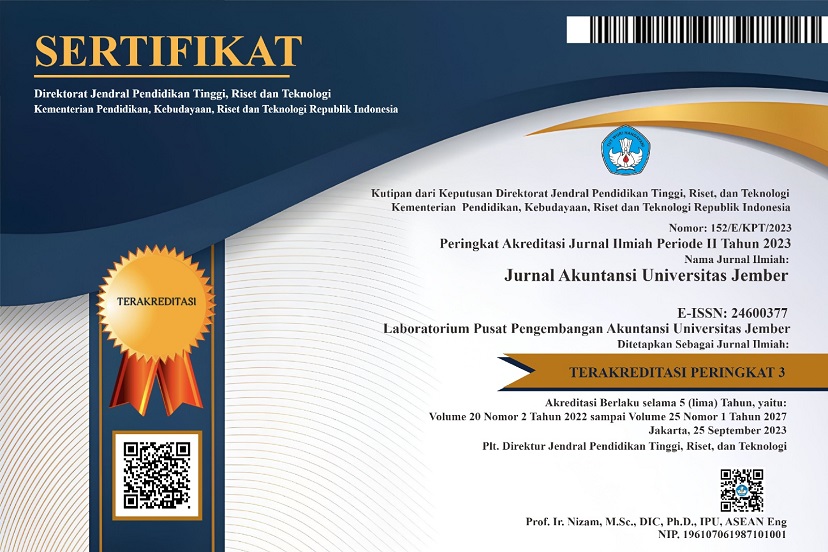

APAKAH RELIGIUSITAS, GENDER, DAN TINGKAT PENDIDIKAN BERPENGARUH PADA PEMBAYARAN ZAKAT?

DOI:

https://doi.org/10.19184/jauj.v20i1.30994Keywords:

Education Level, Gender, Religiosity, ZakatAbstract

This study aims to see the effect of religiosity, gender, ethics and level of education on the payment of zakat. In addition, it also examines the religiosity dimension whether it has a significant effect on zakat payments. This study finds evidence that religiosity and gender have a significant effect on zakat payments, while ethics and education level have no effect on zakat payments. The data used in this study is primary data. The data collection technique used a questionnaire which was distributed to 150 respondents. The sampling technique used is the snowball sampling method.

Keywords: Education Level, Gender, Religiosity, Zakat

ABSTRAK

Penelitian ini bertujuan untuk melihat pengaruh dari religiusitas, jenis kelamin, etika dan tingkat pendidikan terhadap pembayaran zakat. Selain itu juga menguji dimensi religiusitas apakah berpengaruh secara signifikan terhadap pembayaran zakat. Pada penelitian ini menemukan bukti bahwa religiusitas dan gender berpengaruh signifikan dalam pembayaran zakat, sedangkan etika dan tingkat pendidikan tidak berpengaruh dalam pembayaran zakat. Data yang digunakan dalam penelitian ini adalah data primer. Teknik pengumpulan data menggunakan kuesioner yang disebar ke 150 responden. Teknik pengambilan sampel yang digunakan adalah metode snowball sampling.

Kata Kunci: Gender, Religiusitas, Tingkat Pendidikan, Zakat

Downloads

References

Adnan Khurshid, M., Al-Aali, A., Ali Soliman, A., & Mohamad Amin, S. (2014). Developing an Islamic corporate social responsibility model (ICSR). Competitiveness Review An International Business Journal Incorporating Journal of Global Competitiveness, 24(4). https://doi.org/10.1108/cr-01-2013-0004

American Accounting Association, C. on C. and S. for E. F. R. (1997). Statement on Accounting Theory and Theory Acceptance. Sarasota, FL:AAA.

Becker, H., & Fritzsche, D. J. (1987). Business ethics: A cross-cultural comparison of managers’ attitudes. Journal of Business Ethics, 6(4), 289–295. https://doi.org/10.1007/bf00382938

Bowman, R. (1980). The debt equivalence of leases: An empirical investigation. The Accounting Review 55 (April), 237–253.

Bowman, R. G. (1980). The Importance of a Market-Value Measurement of Debt in Assessing Leverage. Journal of Accounting Research 18 (Spring), 1, 617–630. https://doi.org/10.2307/2490400

Cohen, C. (1991). Chief of Indians-woman in accountancy. Australian Accountant (Desember), 20–30.

Farah Mastura Noor Azman and Zainol Bidin. (2013). Zakat Compliance Intention Behavior On Saving. Proceedings Of World Universities’ Islamic Philanthropy Conference .

Geyer, A. L. , & B. R. F. (2005). Religion, Morality, and Self-Control: Values, Virtues, and Vices. In R. F. Paloutzian & C. L. Park (Eds.), Handbook of the Psychology of Religion and Spirituality , 412–432.

Hairunnizam, W. , S. A. and M. A. M. N. (2007). Kesedaran Membayar Zakat Pendapatan di Malaysia. Islamiyyat, 29(53–70).

Harry, J., & Goldner, N. S. (1972). The Null Relationship Between Teaching and Research. Sociology of Education, 45(1), 47–60. https://doi.org/10.2307/2111831

Idris, K. M. , A. E. I. E. and A. J. (2003). The role of intrinsic motivational factors on compliance behavior of zakat on employment income. Jurnal Pembangunan Social, 6/7, 95–122.

Irwin, M. G. G. , F. L. G. dan C. J. W. eds. (1991). Encyclopedia of banking and finance. Encyclopedia of Banking and Finance.

Jensen, M. C., & Smith Clifford W., Jr. (2000). Stockholder, Manager, and Creditor Interests: Applications of Agency Theory. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.173461

McDaniel, S. W., & Burnett, J. J. (1990). Consumer religiosity and retail store evaluative criteria. Journal of the Academy of Marketing Science, 18(2), 101–112. https://doi.org/10.1007/bf02726426

Mohd Rizuan, A. K. Z. A. Z. A. R. J. S. K. N. (2014). Factors Influencing A Business Towards Zakat Payment In Malaysia. International Journal of Science Commerce and Humanities, Vol No 2.

Mustafa, M. & M. M. H. S. & A. M. (2011). Antecedents of Zakat Payers’ Trust: The Case of Nigeria. International Journal of Economics, Management & Accounting, 133–164.

Narsa, N. P. D. R. H., & Wijayanti, D. M. (2021). The importance of psychological capital on the linkages between religious orientation and job stress. Journal of Asia Business Studies, 15(4), 643–665. https://doi.org/10.1108/jabs-09-2018-0251

Nor, M. A. M. , W. H. and N. N. G. M. (2004). Kesedaran Membayar Zakat Pendapatan di Kalangan Kakitangan Profesional Universiti Kebangsaan Malaysia. Islamiyyat, Vol. 26 No. 2, 59–67.

Ohslon, J. A. (1991). Earning, book values, and dividends in security evaluation. Working paper. Working Paper. Columbia University.

Qardhawi, Y. (2000). Fiqh Al Zakah A Comparative Study of Zakah, Regulations and Philosophy in the Light of Quran and Sunnah. 1.

Rahman, T. (2015). AKUNTANSI ZAKAT, INFAK DAN SEDEKAH (PSAK 109): Upaya Peningkatan Transparansi dan Akuntabilitas Organisasi Pengelola Zakat (OPZ). Muqtasid: Jurnal Ekonomi Dan Perbankan Syariah, 6(1), 141. https://doi.org/10.18326/muqtasid.v6i1.141-164